We provide SMEs with direct lending solutions secured by cash tax rebates due under the R&D

Incentive Scheme, investors can generate strong returns with an attractive risk profile.

The Innovation Nation

As Australia transitions from a mining lead economy, it is positioning itself as the “Innovation Nation”

A key component of this strategy is adequate investment in research and development (R&D) for SME companies.

By providing SMEs with direct lending solutions secured by cash tax rebates due under the R&D Incentive Scheme, investors can generate strong returns against an attractive risk profile.

Trustee

Mitchell Asset Management

Investment Manager

Mitchell Investment Management

Asset Class

Secured Debt

Expected Returns for Investors

10%+ (net of fees)*

Minimum Investment

AUD $25,000

Specific, Segments & Scale

R&D Scheme

R&D spending is actively encouraged by the Federal government via its R&D Tax Incentive Scheme.

R&D tax incentives have a strong history, with Australian R&D companies benefiting from such incentives since 1985.

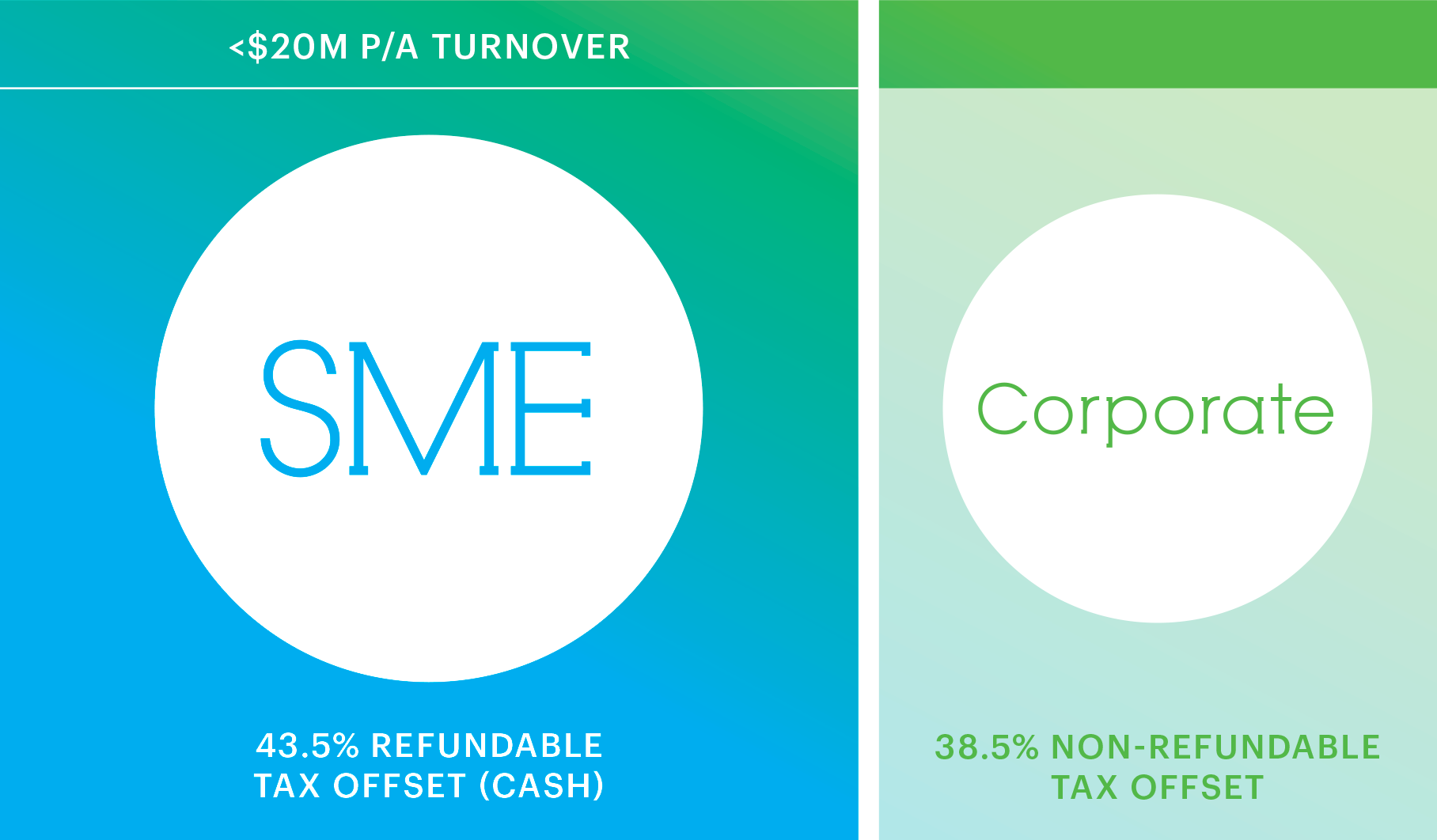

Eligible SMEs can qualify for a 43.5% refundable cash offset and there are more than 11,000 SMEs registered for the R&D Tax Incentive.

The actual cost to the Federal budget was estimated at $3bn in FY13/14 and is expected to grow to $3.5bn by FY17/18.

The Cash flow squeeze

The Problem for SME’s

While the R&D cash tax rebate is a very effective incentive, SMEs involved in R&D still face a possible cash flow squeeze.

Timing considerations when filing tax returns can often mean SMEs wait months before receiving R&D rebates due.

Let us tailor a solution that will allow you to benefit from the R&D Tax Incentive scheme

Capturing a premium for investors

The Opportunity

SME options to alleviate this R&D cash flow squeeze are often costly and bring onerous conditions and/or risk.

By utilizing cash rebates as security for direct lending, the Innovation Finance Fund offers a realistic alternative for SMEs and allows investors in the Innovation Finance Fund to capture the premium available.

Once an SME has a confirmed registration for qualifying R&D expenditure, the obligation to pay a tax refund lies with the Commonwealth of Australia – a Sovereign Credit Rated entity.

Objective risk assessment with strong security structure

The Strategy

The credit underwriting and approval process is largely objective with eligibility for registration determined via a strict set of criteria.

The Innovation Finance Fund will use only registered R&D specialists when determining SME eligibility for R&D rebates. Further, the Innovation Finance Fund mandates documented security over the R&D rebate while maintaining control over the bank account into which cash rebates are deposited.

These objective risk parameters, use of R&D experts and strong security structure all serve as active risk mitigants and assist in maintaining investor returns.

Borrow using the IFF

Financing your business can bring many potential frustrations and we are pleased to offer the Innovation Finance Fund as an effective alternative for you.

Learn moreFind out more

To request a brochure, please

contact us on 9826 0003

or email info@mitchellam.com.

Alternatively, fill out the form opposite, and

one of our staff will be in touch shortly.